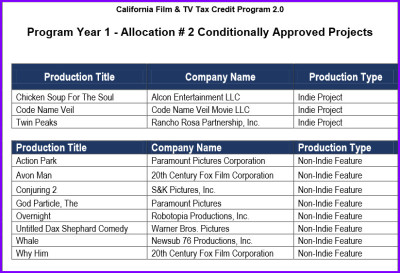

August 19 2015 – The California Film Commission this week announced its list of 11 non-independent feature films and independent projects as the first selected to receive tax credits under the state’s recently expanded Film and Television Tax Credit Program 2.0.

Under the expansion, signed into law September 18, 2014 by Governor Brown, tax credit allocation more than tripled California’s then film and television production incentive, from $100 million to $330 million annually. Aimed at retaining and attracting production jobs and economic activity across the state, the California Film and TV Tax Credit Program 2.0 also extends eligibility to include a range of project types (big budget feature films, TV pilots and 1-hour TV series for any distribution outlet) that were previously excluded. Other key changes include replacing the lottery system with a “jobs ratio” ranking system that selects projects based on wages paid to below-the-line crew, qualified spending such as vendors, and other criteria. “Uplifts” are also now available for projects shooting outside the magical Los Angeles 30-mile zone or which have qualified expenditures for visual effects or music scoring.

11 productions have received conditional approval; eight non-independent feature films and three independent projects, which includes projects set at least partially in other locales that have been especially aggressive in their effort to use tax credits to lure film and TV production from California. These projects include CONJURING 2 (United Kingdom) and WHY HIM (Michigan).

A determined and enthusiastic Amy Lemisch, Commission Executive Director, vows “We’re fighting back and winning thanks to our newly expanded tax credit program. We were losing projects that were set here at home, and now we’re back to doubling for other locales. This demonstrates that when the playing field is more level, the industry views California as the first and best option.”

This upward trend began in May with the first allocation for California’s expanded tax credit program, which was earmarked specifically for TV projects. That allocation resulted in four TV series relocating to California from other high level production states; Georgia, Louisiana, Maryland and North Carolina.

Lemisch also noted that the independent film projects announced are from production companies that rarely work in California, opting instead to shoot in states where tax credits have been more readily available and favorable.

Alcon Entertainment, one of the independent production companies selected to receive tax credits, has not filmed a project entirely in California in over a decade. Andrew Kosove and Broderick Johnson, Co-Founders and Co-CEOs of Alcon Entertainment, are part of this movement. “We are excited to be coming back to California to film CHICKEN SOUP FOR THE SOUL. We’re looking forward to working with the greatest crews and top facilities with the convenience of managing this project close to home.”

In addition to attracting projects set elsewhere and/or from producers who traditionally bypass California, this list of approved projects includes some that will shoot within the state but outside the Los Angeles 30-mile zone. According to Lemisch, “Five of the selected films are planning to shoot a collective 77 days outside the 30-mile zone. This is an early indicator that the new program’s added incentives for filming outside the zone are working and achieving the intended result.”

Based on data provided with each application, the 11 approved projects announced today will generate an estimated $533 million in direct in-state spending, of which $71 million is in wages for below the line crew.

The latest tax credit program application period (held July 13-25) made available $48.3 million for non-independent feature films, and $6.9 million for independent projects. This latest round of funding totals $55.2 million out of the program’s $230 million in the first fiscal year funding. (It should be noted that $100 million of the $330 million total annual funding is allocated to the final round of the state’s expiring, first generation tax credit program.)

Although the list of currently approved tax credit projects may be revised pending a project’s withdrawal from the program, those funds will be immediately reallocated and reassigned to those other projects currently on the wait list. Approved projects are selected based on their jobs ratio score, which ranks each project by wages to below-the-line workers, qualified spending for vendors, equipment, etc. and other criteria. The top 200% ranked projects in each round go on to compete for tax credits. Those not selected are placed on a wait list. The California Film Commission awards tax credits only after each selected project (1) completes post-production, (2) verifies that in-state jobs were created, and (3) provides all supporting documentation reflecting same, including audited cost reports.

Remaining application periods for the current fiscal year ending June 30, 2016, are as follows:

November 30 – December 6, 2015: TV Series, Mini-series, MOWs, Pilots and Relocating TV series

January 11-24, 2016: Independent Projects and Non-Independent Feature Films

February 15-21, 2016: TV Series, Mini-series, MOWs, Pilots and Relocating TV series

For more information on California’s Film and Television Tax Credit Program 2.0, go to http://film.ca.gov/incentives.